Georgian or imported? How do consumers choose groceries

Georgian or imported? How do consumers choose groceries

Georgian or imported? This question is part of many consumers’ daily choices. In today’s market, consumers often have to choose between Georgian and imported products. This choice can be determined by various factors – origin, trustworthiness, taste, habit, price attitude, and others. To understand what criteria people follow when selecting food products and what role the product’s origin plays, “ACT Research” conducted a public opinion survey.

If imported? How do consumers choose groceries?

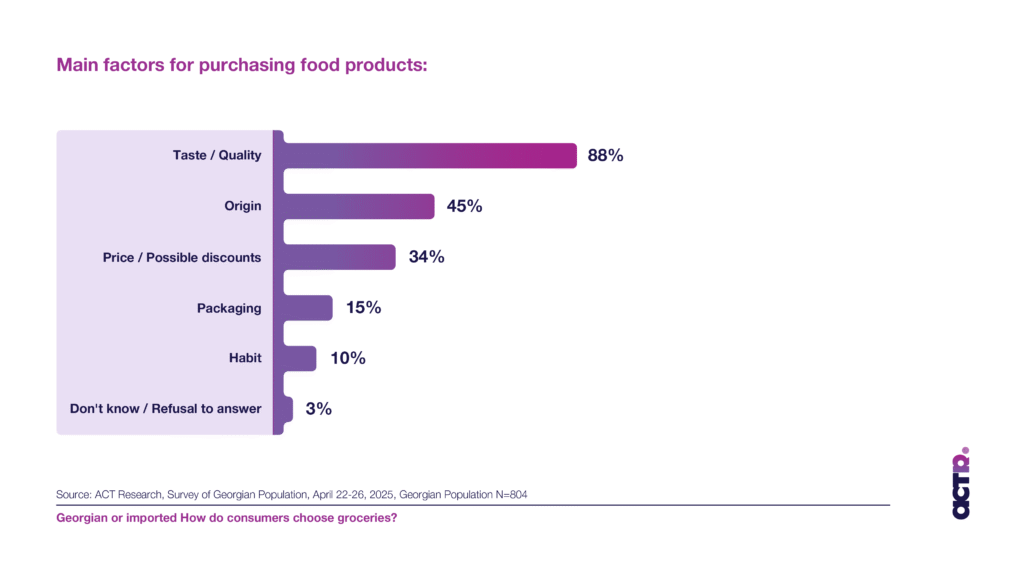

When it comes to purchasing groceries, research shows that taste and quality are of decisive importance for Georgian consumers – 88% of respondents primarily choose products based on these characteristics.

The product’s origin is named as the second most important factor – 45% attach great importance to this factor as well. 34% of consumers focus on price.

This indicates that consumers mainly choose products based on taste and quality, although their choice is also influenced by where the product is produced and at what price it is sold.

Georgian Consumers’ Choice – Local or Imported Groceries?

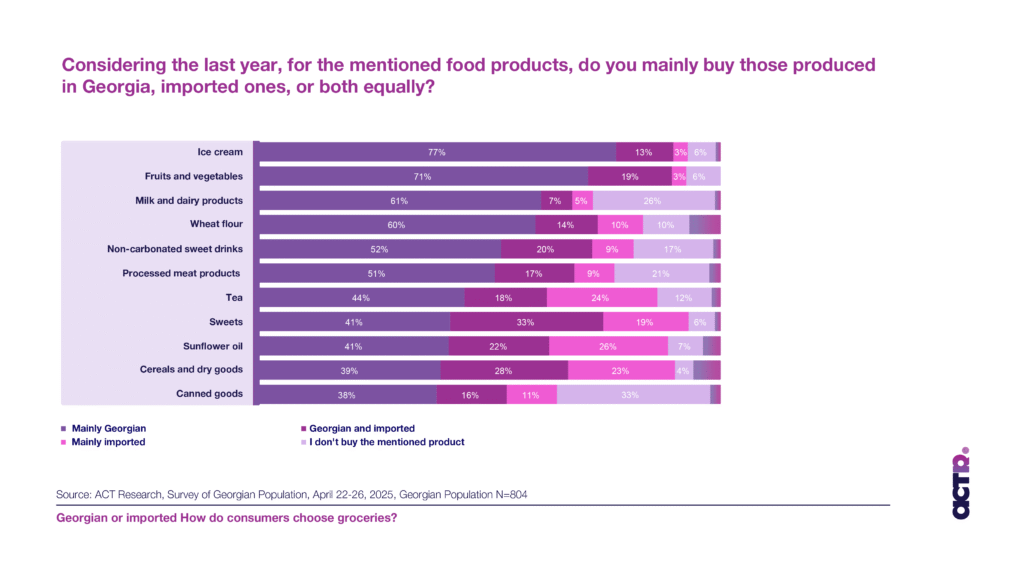

The study found that consumers use different approaches when choosing groceries – there are categories where they prefer local products and others where they more often choose foreign ones.

Georgian products hold the strongest position in the following categories: ice cream, vegetables, fruits, dairy products, milk, and flour. In these segments, the share of imported products is low, and the choice is primarily made for local goods.

Categories such as tea, sweets, sunflower oil, and cereals are relatively balanced for consumers – here, the choice between Georgian and imported products is almost equally distributed.

Foreign products are most frequently purchased in the case of sunflower oil and cereals/groceries – in these categories, the share of imported goods is the highest compared to others.

The research results showed that product selection rules differ across various groups.

Consumers in the regions more often prefer Georgian products than in Tbilisi. In almost all product categories, the regional indicator exceeds that of the capital, which points to their stronger preference for Georgian products.

This difference may have various reasons – for example, product availability in the regions or a closer connection to local produce.

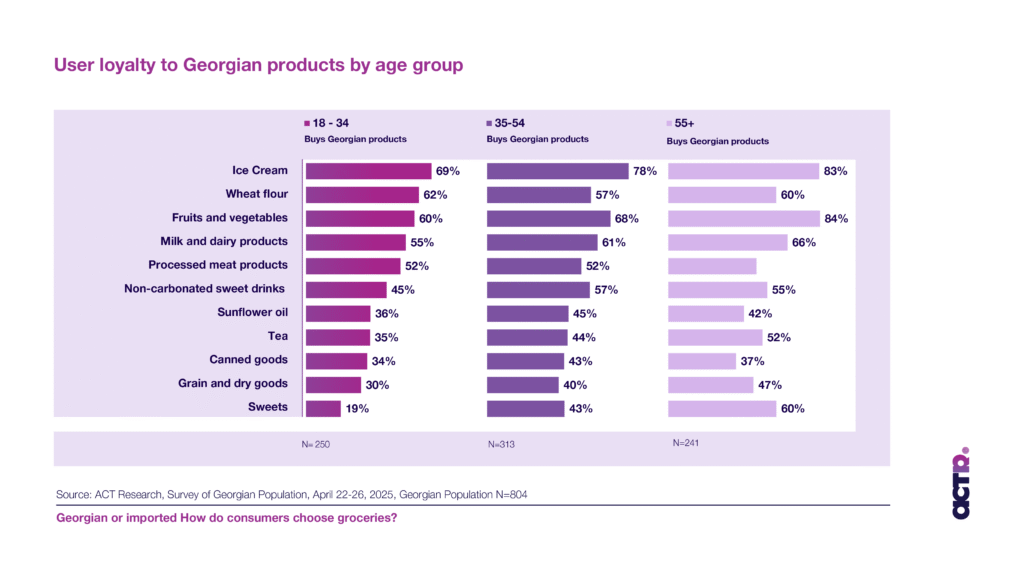

In addition, we find differences when analyzing the data by age group: there’s a noticeable trend that as consumer age increases, so does loyalty towards Georgian products.

The 55+ age group leads in choosing local products in almost all categories, while these figures are significantly lower among young people aged 18-34.

The clearest age difference is found in the sweets category. Only 17% of consumers aged 18-34 prefer Georgian sweets, whereas this figure reaches 42% in the 35-54 age segment, and 59% among those over 55.

Who do we trust – Georgian or imported?

The research results show that most consumers – 54% – place more trust in Georgian-origin food products than in imported ones when making their choices.

Additionally, a significant segment – 39% – trusts local and foreign products equally.

How do consumers perceive product quality based on origin?

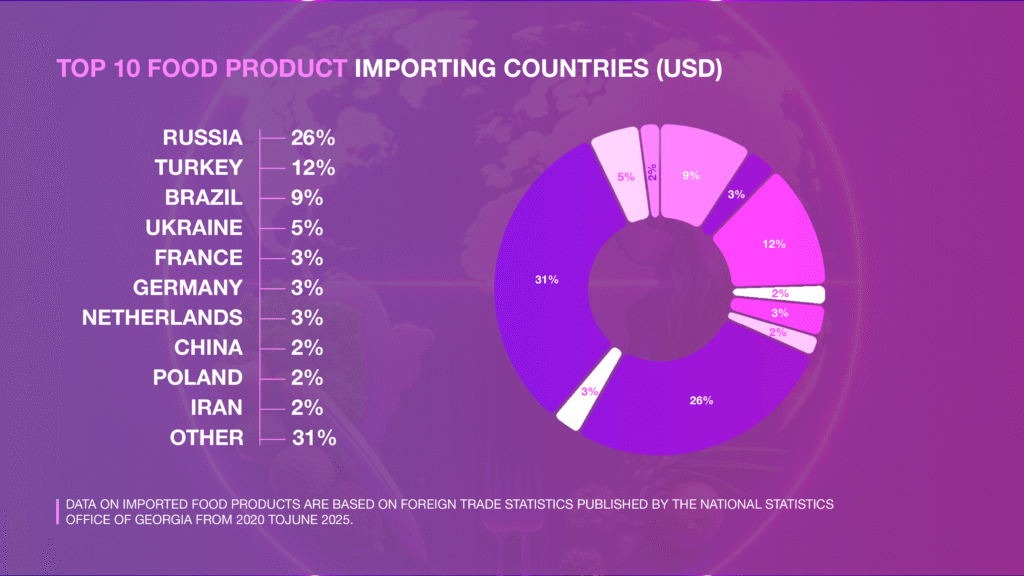

According to data published by the National Statistics Office of Georgia (Geostat), which reflects foreign trade statistics from 2020 to June 2025, it turns out that over the last 5 years, the largest importing countries of food products to Georgia are Russia, Turkey, Brazil, and Ukraine.

Among these, Russia leads in the import of grains, oils, and flour-cereals. Turkey is a leading country for fruits and vegetables, Ukraine for dairy products, while Brazil is a significant importer of meat products, sugar, and confectionery.

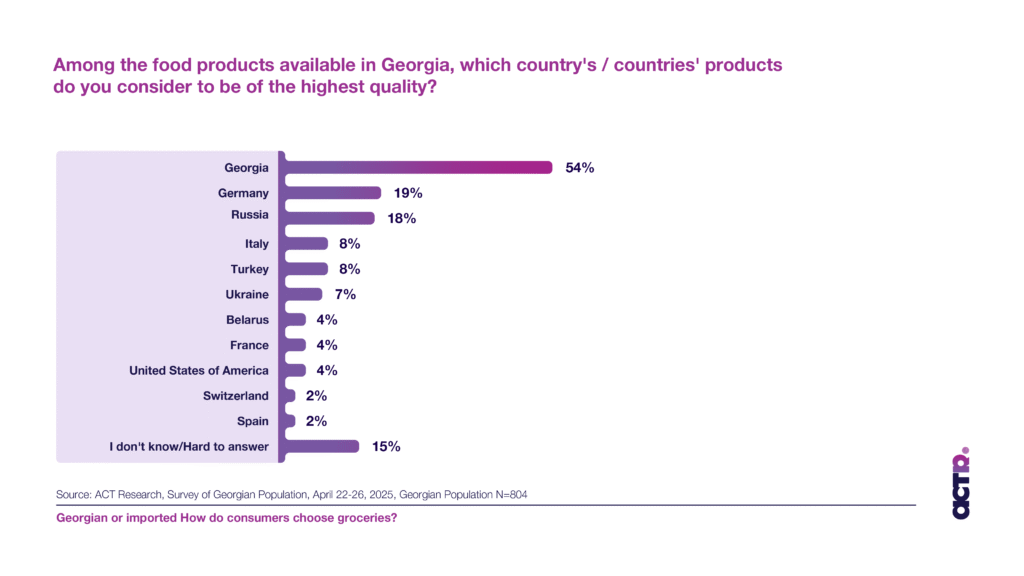

However, beyond import volume, it’s interesting to see how consumers perceive the quality of products from different countries. For this purpose, participants were asked which country’s food products they consider to be of the highest quality. The responses clearly show that consumers’ perception of quality is closely linked to the product’s origin.

According to ACT research results, local products have the highest trust – 54% of respondents believe that food products produced in Georgia are superior in terms of quality. After Georgian products, Germany takes the second position – 19% of citizens name it as the source of the highest quality imported products. It should be noted that according to Geostat data, Germany’s share among imported food products is only 3%, yet consumers perceive it as the country importing the highest quality food after Georgia.

Russia, which is the largest importer of food products in Georgia, holds the third position in terms of perceived quality of food products by citizens – with 18%.

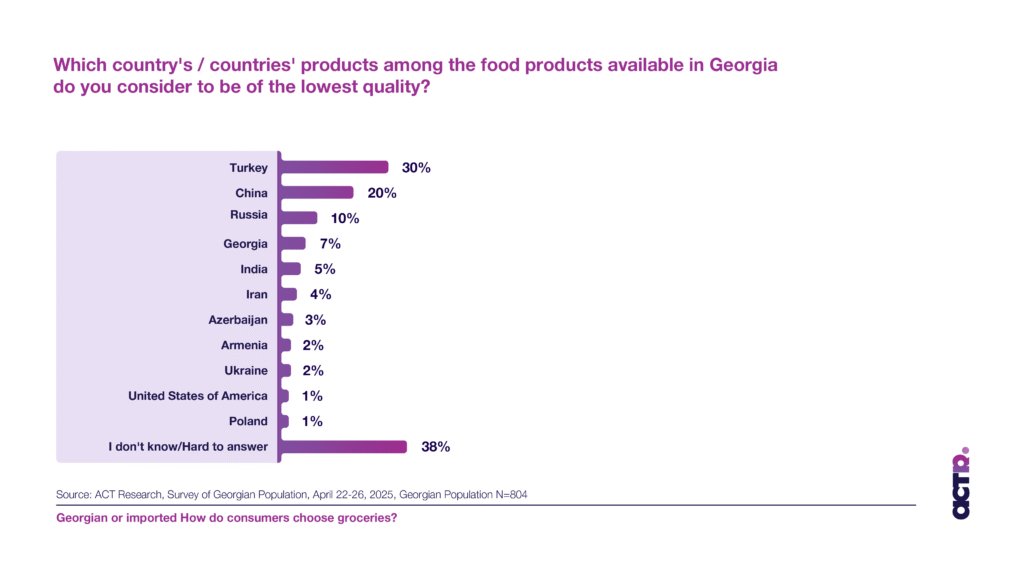

Turkey, which is one of the largest importers of food products, receives relatively less positive evaluations regarding the perception of quality – 30% of respondents name it as a country whose products are associated with low quality.

As for China, despite the fact that according to Geostat data it ranks only eighth in terms of food product import volume and its share in this category is only 2%, 20% of respondents still consider Chinese products to be of low quality. This indicates that consumers’ attitude towards Chinese food products often relies on stereotypes or non-food experiences, and the perception of quality is less connected to actual consumption.

Finally, the research shows that taste and quality are the main determining factors when selecting food products. However, the product’s origin is no less important. Georgian products have a high level of trust among consumers, although there are also those who trust local and imported products equally.

The survey was conducted via random sampling among 804 adult residents across Georgia. The survey took place from April 22-26, 2025. The statistical margin of error for the data, on average, does not exceed 3.5%. The method used was a telephone survey. *Data on imported food products are based on foreign trade statistics published by the National Statistics Office of Georgia (Geostat) from 2020 to June 2025.

This study was conducted at the initiative of the company “ACT Research” (ACTR) within the framework of its Corporate Social Responsibility (CSR) program, under the rubric “The Voice of the Customer.”

ACTR’s CSR policy is based on an approach focused on public well-being and the generation of timely, evidence-based data to better understand societal issues. To this end, ACTR periodically conducts public opinion research in four main areas:

“Voice of Society” – studying social and civic attitudes;

“Voice of the Consumer” – analysis of consumer behavior and needs;

“Voice of Business” – research on private sector trends and expectations;

“Digital Trends” – monitoring technological and digital changes.

The goal of the initiative is to improve access to data and promote informed, public interest–based decision-making in both the private and public sectors.

ACTR ensures data transparency and accessibility – as one of the key mechanisms for creating public value.